The wine market is currently undergoing a period of uncertainty and challenges, prompting many industry professionals to reflect on potential responses and strategies to adopt. The difficulties are tangible: sales are not growing as expected, buyers’ doors seem to be closing, and despite efforts, results often do not materialize. However, looking at the numbers can provide a clear view of the situation and possible solutions.

USA wine market data: an analysis

The UIV Wine Observatory has recently presented an analysis of the U.S. market, one of the primary destinations for Italian wine exports, using data provided by Sipsource. The report reveals a mixed picture, with positive signals but also areas requiring attention.

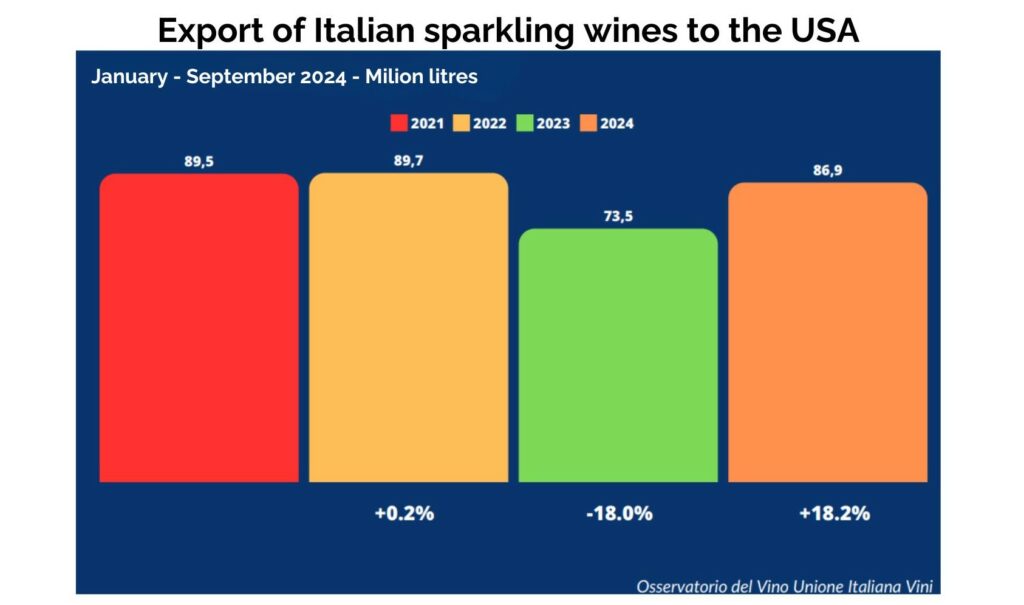

Specifically, the Italian sparkling wine market has seen a significant increase of +18.2% in the first nine months of 2024 compared to the same period last year, which had experienced a decrease of -18%. This is certainly a positive result, marking a substantial recovery, albeit from a low base.

However, bottled wine exports, excluding sparkling wines, have shown a modest increase of 0.7% compared to last year, after a -10.2% drop in 2023. Although this year’s data might seem encouraging, it raises an important reflection: we are recovering, but from a level that was already low. Therefore, it is crucial to understand that while there are positive signs, the overall situation remains fragile.

Italian wine sales analysis

Data on the sales of Italian bottled wine in the first ten months of 2024 provides an interesting overview of consumption trends:

- Sparkling wines increased by +2.2%

- Red wines decreased by -7%

- White wines declined by -6.4%

- Rosé wines saw a drop of -6.9%

- Flavored wines suffered a decline of -17.6%

The most noteworthy data concerns red wines, which have seen a decline both in Italy and internationally. Indeed, other major wine producers, such as France (-4.9%), Spain (-5%), Argentina (-13.3%), Australia (-11.8%), and Chile (-4.7%), have also seen reduced red wine sales, signalling a shift in consumer preferences.

Among the Italian denominations, the most significant drops are recorded for:

- Chianti: -2.3%

- Chianti Classico: -11.4%

- Valpolicella: -6.3%

- Barolo: -10.2%

The case of Brunello: a bright exception

An interesting exception is represented by Brunello di Montalcino, which has seen a sales increase of +7.2%. This positive result is not by chance: it is the result of targeted work on communication, positioning, branding, and product quality. In recent years, Brunello has benefited from growing attention from producers who have invested in marketing strategies and tourist hospitality, strengthening the brand’s perception and its presence in the international market.

The challenges for Barolo and Valpolicella

While Brunello represents a success story, other denominations like Barolo and Valpolicella are facing difficulties. Barolo, one of the most iconic labels in Italy’s wine landscape, has seen a sales decline of -10.2%. This phenomenon raises questions about how consumption patterns have evolved and how the market has changed. In the past, Barolo wineries quickly sold out their products; today, the situation is different, and demand is slowing down, forcing producers to rethink their strategies. Similarly, Valpolicella must now face a situation that requires a reflection on the future. How can these data be addressed? What marketing and communication strategies should be adopted to recover lost ground?

The need to innovate strategies of the Italian wine market

The wine market is changing, and to remain competitive, innovation is essential. Traditional sales and distribution techniques are no longer sufficient, especially as consumption habits and consumer preferences evolve. Therefore, Italian producers must adapt by investing in marketing strategies, branding, and positioning that respond to the demands of the modern market. While the wine industry is going through a challenging period, opportunities still exist. However, recovery requires a radical shift in approach: a combination of innovation, quality, and strategic communication can make all the difference and ensure that Italian wines continue to be key players in international markets.

Would you like to learn more about my services as a wine consultant, writer, and speaker? https://www.patriziavigolo.it/

Want to know more about Vino&Beyond? https://www.vinoandbeyond.com/about/